Kangaroos and Boomerangs

- Adam Wolszczak

- Mar 26, 2025

- 2 min read

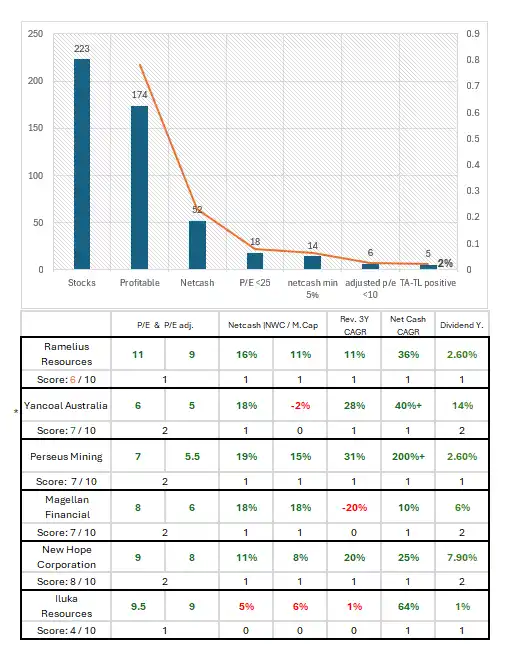

Will the Boomerang bring back proftits - Ausrtalia 4% of Portfolio Exploring Australian Market Strengths: Focused on Cash-Strong Miners and Financials Australia is more than just a hub for natural resources; it's a region of stable and cash-rich companies, particularly in mining. From a pool of 223 stocks, I narrowed down my portfolio to those with profitable and net cash positions, yielding a select list with consistent performance and growth potential. Here’s a closer look at the standout companies, as they make up ~4-5% of the

Portfolio:

Ramelius Resources – With an impressive 36% CAGR in net cash, Ramelius demonstrates a robust growth trajectory, backed by a solid 2.6% dividend yield. Although its P/E of 11 may appear modest, its strong cash reserves and steady returns make it an attractive choice for risk-conscious investors.

Yancoal Australia – A net cash leader with over 40% CAGR in the last three years, Yancoal offers a dividend yield of 1.4%. Despite the volatility in the coal sector, Yancoal’s strong cash flow and low P/E ratio (6) help it stand out.

Perseus Mining – A growing mid-tier gold producer with over 200% net cash CAGR, Perseus combines strong cash positions with a dividend yield of 2.6%. It’s well-positioned in the gold sector, which can be a hedge in uncertain times. Magellan Financial – Magellan faced revenue contraction, yet its balance sheet remains healthy. A P/E of 8 and a 7% dividend yield indicate it’s a solid choice for income investors willing to ride out fluctuations.

Iluka Resources – Iluka’s 64% net cash CAGR and low P/E of 9.5 make it an attractive long-term play. With the mineral sands industry showing promising demand, Iluka stands out as a compelling investment in materials. What’s the Strategy? In a volatile global economy, net cash companies provide stability and flexibility. The focus is on Australian stocks with strong financial health and consistent dividends. Each company here has a significant net cash position, enhancing their resilience and allowing for strategic investments, expansions, or dividends.

Comments